Everything You Have To Know About Home Mortgages

Article created by-Atkins LundSome people find getting a home loan a tricky process. If you want to learn more about home mortgages, this article can help you. Keep reading into the following paragraphs to learn some beneficial tips and pieces of wisdom that can help you discover a good mortgage.

Do not sign up with the first mortgage lender that you come across. There are so many out there that you would be doing yourself a disservice by being hasty. You should shop around a bit to make sure that the rate you are being offered is fair and competitive.

Before you refinance your mortgage, make sure you've got a good reason to do so. Lenders are scrutinizing applications more closely than ever, and if they don't like the reasons you're looking for more money, they may decline your request. Be sure you can accommodate the terms of the new mortgage, and be sure you look responsible with the motivations for the loan.

Try to find the lowest available interest rate. Lenders will do their best to only offer you the highest rates they can get you to accept. Avoid being https://www.bankrate.com/banking/credit-unions/credit-union-pros-and-cons/ sucker in. Make sure you're shopping around so you're able to have a lot of options to choose from.

Reducing your debt as much as possible will increase your chances of being approved for a mortgage. If you are not in a good financial situation, meet with a debt consolidation professional to get out of debt as quickly as possible. You do not need to have a zero balance on your credit cards to get a mortgage but being deeply in debt is definitely a red flag.

Even if you are underwater with your mortgage, the new HARP regulations can help you get a new loan. In the past it was next to impossible to refinance, but this program makes it much easier to do so. Check it out and see if it can help you.

Before you sign the dotted line on your refinanced mortgage, be sure to get full disclosure of all costs involved in writing. This needs to incorporate all your closing costs, as well as any other fees for which you are personally responsible, now and in the future. Most lenders will be honest about the costs, but there are some that will try and get one over on you.

Do not take out a mortgage loan for more than you can comfortably afford to pay back. Sometimes lenders offer borrowers a lot more money than they need and it can be quite tempting since it would help you purchase a bigger house. Decline their offer because it will lead you into a debt pit you cannot get out of.

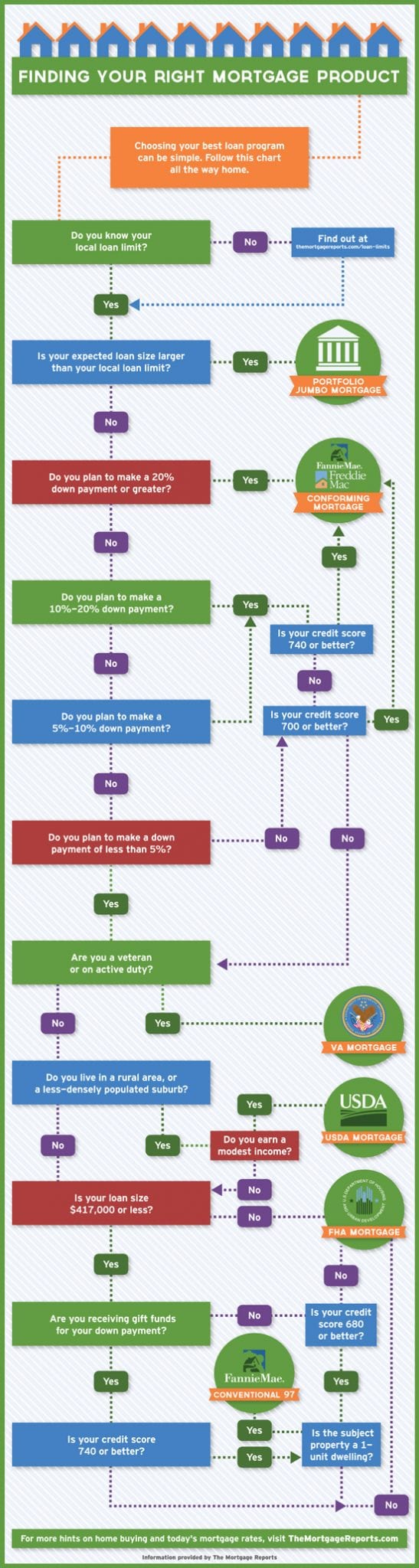

If you are a veteran of the U.S. Armed Forces, you may qualify for a VA morgtage loan. These loans are available to qualified veterens. The advantage of these loans is an easier approval process and a lower than average interest rate. The application process for these loans is not often complicated.

Make sure you pay down any debts and avoid new ones while in the process of getting approved for a mortgage loan. Before a lender approves you for a mortgage, they evaluate your debt to income ratio. If your debt ratio is too high, the lender can offer you a lower mortgage or deny you a loan.

Make sure that you have a good amount of savings before you get yourself into a home mortgage contract. There are not certainties when it comes to the economy or job stability. To protect yourself you want to have enough money saved to make your payments for many months in case the worst does occur.

Keep in mind that not all mortgage lending companies have the same rules for approving mortgages and don't be discouraged if you are turned down by the first one you try. Ask for an explanation of why you were denied the mortgage and fix the problem if you can. It may also be that you just need to find a different mortgage company.

Pay at least 20% as a down payment to your home. This will keep you from having to pay PMI (provate mortgage insurance) to your lender. If https://www.cnbc.com/2019/06/26/separate-bank-accounts-do-not-protect-you-in-a-divorce-here-is-what-will.html pay less than 20%, you very well may be stuck with this additional payment along with your mortgage. It can add hundreds of dollars to your monthly bill.

When trying to figure out how much of a mortgage payment you can afford every month, do not neglect to factor in all the other costs of owning a home. There will be homeowner's insurance to consider, as well as neighborhood association fees. If you have previously rented, you might also be new to covering landscaping and yard care, as well as maintenance costs.

Remember that interest rates are currently very low, and that means they can only go up from here. How would that impact your finances? Would you be able to afford them if they went up? If not, consider how large a mortgage you could afford in that situation instead.

Opt out of credit offers before applying for a home mortgage. Many times creditors will pull a credit file without your knowledge. This can result in an immediate decline for a home mortgage. To help prevent this from happening to you, opt out of all credit offers at least six months before applying for a loan.

If you have previously been a renter where maintenance was included in the rent, remember to include it in your budget calculations as a homeowner. A good rule of thumb is to dedicate one, two or even three perecent of the home's market value annually towards maintenance. This should be enough to keep the home up over time.

Be sure that you know exactly how long your home mortgage contract will require you to wait before it allows you to refinance. Some contracts will let you within on year, while others may not allow it before five years pass. What you can tolerate depends on many factors, so be sure to keep this tip in mind.

Taking out a loan is something that should be taken seriously. This is especially true for a home mortgage. It is important for you to find the best loan for your home. The information in this article should give you assistance in finding the best loan for your house purchase.